Negotiating at Gunpoint

No one likes being bullied into submission, stripped of dignity, and cornered into a deal where “negotiation” is just a polite word for capitulation—even when the other side holds all the leverage. For political leaders on the receiving end, it’s not just a policy loss—it’s public humiliation. Worse, conceding under such pressure legitimizes autocratic behavior, setting a dangerous precedent in which coercion, not compromise, defines the rules of global trade. This is no hypothetical. It’s the blueprint of Trump’s second-term trade doctrine. Surrounded by tariff ideologues like Peter Navarro, Robert Lighthizer, and Howard Lutnick, Trump has resurrected a 21st-century McKinleyan vision—one where tariffs are not tools of last resort, but the very foundation of U.S. trade policy.

In this world, allies are simply countries the U.S. doesn’t run a trade deficit with, and foes are those accused of exploiting the liberal economic order through “predatory” practices: currency manipulation, state-subsidized overproduction, dumping, and intellectual property theft. In Trump’s telling, these tactics have hollowed out American manufacturing and fueled a new wave of inequality—a direct product of the global system itself. The solution, as his administration sees it, is to impose a new trade framework—one that restores “balance,” reclaims sovereignty, and brings production back home. “Fair trade,” under this model, doesn’t mean negotiation. It means punishment. If consumers, allies, or decades of multilateral norms get caught in the crossfire, so be it. The ends justify the means.

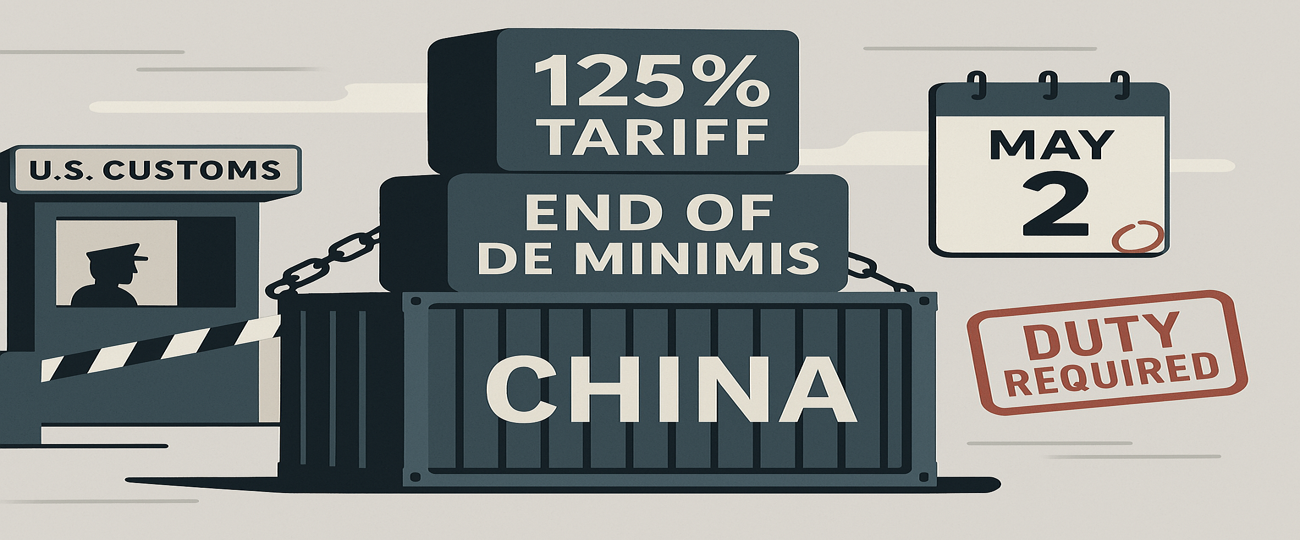

That ethos was made official on April 2, 2025—what Trump triumphantly dubbed Liberation Day—when his administration announced a sweeping retaliatory tariff targeting over 90 nations. But buried in that announcement was a quieter, more consequential maneuver: the suspension of the de minimis rule for shipments from China and Hong Kong. In Trump’s eyes, de minimis has become yet another loophole—one more lever of Chinese advantage to be shut down. It may sound trivial on paper, but the suspension of de minimis is emblematic of a much larger shift: a superpower lashing out to maintain control, while slowly eroding the very order that gave it power to begin with. It’s not just a customs rule—it’s the frontline of a retreating empire. And in the end, this is how decline happens—not with a bang, but package by package.

Tiny Threshold, Massive Stakes: Introduction to De minimis

The de minimis exemption plays an increasingly vital role in today’s global economy, particularly for working-class consumers and small businesses. Under this rule— first codified in Section 321 of the Smoot Hawley-Tariff Act—companies can ship up to $800 worth of goods to a U.S. recipient each day without paying tariffs or undergoing full customs procedures.

Originally created to streamline low-value imports and lower consumer costs, the policy has become foundational to the rapid rise of direct-to-consumer trade. The U.S. has one of the most generous de minimis thresholds in the world, allowing tariff-free imports with a far higher threshold than the average of around $150 across other countries. In recent years, nations like the EU, Brazil, and Turkey have moved to lower or eliminate their thresholds entirely, citing concerns over revenue loss and unfair competition, even as the U.S. maintains its broad exemption.

In 2024, more than 1.3 billion packages entered the U.S. tariff-free under the de minimis provision—roughly 60% of which originated from China. While platforms like Shein and Temu, which now rival Amazon in user base, depend on this mechanism to minimize costs and expedite fulfillment, so too do thousands of American small businesses and suppliers seeking to avoid customs-related delays when importing parts, prototypes, and finished goods.

While some critics frame de minimis as a loophole ripe for abuse, recent research shows it operates as a progressive trade policy. Lower-income and minority households are more likely to rely on tariff-free imports, often spending a larger share of their budgets through this channel. Rolling it back would effectively impose a regressive tax on the very people most sensitive to price increases—at a time when inflation and inequality are already straining household budgets. Worse, ending de minimis would bog down U.S. Customs with a flood of paperwork and formal entries, slowing down supply chains and raising costs for everyone. Businesses would face longer delays, consumers would see higher prices, and the administrative burden on customs officials would skyrocket, especially as e-commerce continues to grow.

The issue has taken on new urgency as former President Trump ordered the end of the de minimis exemption for shipments from China and Hong Kong, effective May 2. His administration claims the move will crack down on fentanyl smuggling and close a loophole that allows companies like Shein and Temu to avoid tariffs. Emerging investigations do reveal instances of fentanyl smuggling via de minimus shipments, the scope and frequency still remain unclear. Critically, Customs and Border Protection (CBP) officials have repeatedly cited lack of staff and screening capacity as the more immediate challenge. A real crackdown would demand massive investment in customs infrastructure, personnel, and detection technology. Without dramatically scaling up inspection capacity, the policy amounts to a symbolic gesture that directly shifts the costs of it to consumers and small businesses without solving the core problem Targeting small consumer parcels may play well politically—but in operational terms, it’s a blunt instrument that misses the mark.

The de minimis rule—originally designed to streamline low-value imports—now covers over a billion packages a year, and eliminating it for Chinese-origin shipments will burden U.S. Customs with mountains of new paperwork, slow delivery times, and drive up costs for consumers and small businesses alike. While some lawmakers and trade hardliners like Robert Lighthizer see this as a necessary move to counter China’s trade practices, the likely result is strategic evasion: Chinese firms could reroute goods through de minimis-exempt countries like Mexico or Southeast Asia, or establish new wholesale networks abroad. This raises a serious question—will this strategy curb illicit activity and protect American manufacturing, or simply signal toughness while shifting costs onto everyday Americans?

Main Street in the Crossfire

Eliminating the de minimis exemption would function as a regressive tax, raising prices most sharply for the working class. At the benchmark administrative fee, the loss in consumer welfare is estimated at $10.9 billion—roughly $34 per person or $136 per family (Fajgelbaum and Khandelwal, 2024). But these losses are not evenly distributed. In zip codes with median incomes under $40,000, the decline in welfare would be $44 annually, or 0.12% of income—three times the relative burden on wealthier areas. In practice, this means §321, the provision that codifies de minimis, flips an otherwise regressive tariff system into a progressive one. Removing it would do the opposite: deepen material hardship in already-struggling communities, especially in rural regions and post-industrial towns with limited access to affordable retail.

The policy would hit not only consumers, but also carry serious consequences for small U.S. producers. From Amazon third-party sellers to Shopify storefronts and Etsy entrepreneurs, thousands of American businesses rely on de minimis to source affordable components, prototypes, and products from overseas. These aren’t corporate giants—they’re often solo operators or micro-businesses navigating thin margins in an increasingly competitive digital marketplace. Roughly 90% of Shopify merchants are classified as small businesses. On Amazon, more than 60% of sales come from independent sellers, the majority of which are small or medium-sized firms. And on Etsy, the median seller age is just 39, with nearly half under 40—underscoring how de minimis sustains a rising generation of Millennial and Gen Z entrepreneurs building livelihoods online. Most of these sellers don’t have customs brokers or international logistics teams; they depend on the simplicity and affordability of importing goods below the $800 threshold. What’s being framed as a trade loophole is, in reality, one of the most economically inclusive elements of the U.S. trade system. Eliminating it would gut the infrastructure that supports low-cost experimentation and flexible sourcing—undermining not only small business growth, but the economic mobility it enables.

The political implications are paradoxical. Even though eliminating de minimis would disproportionately harm Trump’s own base, the move may still deliver him political benefits. Research shows that voters in regions hit hardest by Chinese import competition were more likely to reward Trump’s tariff policies—even when retaliatory tariffs reduced employment. In this sense, support for Trump’s trade agenda may stem more from its symbolic aggression than its material outcomes. By tying de minimis reform to the fight against fentanyl, Trump has crafted a politically potent—but factually unsubstantiated—justification. Customs and Border Protection lacks the staffing, infrastructure, and detection capacity to meticulously screen for fentanyl in over a billion additional packages, and the revenues from ending de minimis offer no clear path toward funding such efforts. Meanwhile, CBP is already 5,000 officers short; fully eliminating the exemption would require hiring 22,000 more just to manage the administrative overload. For a candidate who touts government downsizing, the contradiction is glaring. Ultimately, this is a high-cost policy with minimal fiscal return—one that risks exacerbating inequality, straining public systems, and punishing the very voters it claims to protect. Whether by design or by indifference, Trump’s tariff-first strategy is isolating the U.S. from the very alliances that were forged in serving as a bulwark against Chinese influence. Ironically, the suspension of de minimis for China is just one front in a broader campaign that risks undermining key trade agreements and pushing global partners into Beijing’s orbit.

China’s Biggest Gift: U.S. Self-Sabotage Wrapped

Rolling back the de minimis exemption for packages from China is more than a customs policy change—it’s a message. For years, the U.S. and China have been locked in growing economic competition, and this move fits into a broader pattern of trade becoming more political. The goal is to punish Chinese e-commerce platforms like Shein and Temu, but in practice, it’s unlikely to stop them. Instead, they’ll adapt by shipping through other countries, taking advantage of the same rules from a different angle. That means more complicated supply chains, more enforcement headaches, and no real progress on fixing what’s actually broken in the U.S.–China trade relationship. At a time when the world is splitting into tighter economic alliances, targeting de minimis could end up isolating the U.S. more than it hurts China.

Politically, it may score points. “Tough on China” is a powerful slogan, especially in areas hit hard by past trade shocks. But going after de minimis won’t bring jobs back or build factories—it just makes everyday goods more expensive, especially for lower-income families and small businesses. These policies risk deepening the very inequality they claim to fix. For a lot of people in rural areas or places with fewer shopping options, low-cost online platforms have become essential. Cutting off access won’t hurt billion-dollar companies as much as it will hurt the people who rely on them. If the U.S. wants to compete with China, it needs a real strategy— centralizing capital, investing in early education and manufacturing at home, securing supply chains, building fair trade deals, and strengthening alliances. Blaming the de minimis exemption might make for good headlines, but it’s not a solution for the material conditions many Americans face. If you want to build a barn (domestic manufacturing), you first need wood (human and physical capital). Showing up with a hammer and nails (trade policy) alone will not build a barn.

This also plays into a larger global shift. The world is slowly moving away from a single, rules-based trade system and toward bloc-based globalization—where countries trade more within their political or strategic alliances than across them. As the U.S. and China drift further apart, we’re likely to see companies rerouting supply chains through partner countries just to keep business flowing. That doesn’t reduce dependence on China—it just hides it behind new layers on wich BRICS nations are capitalizing. The bloc is working to construct a parallel economic order—one that doesn’t require U.S. participation, let alone permission. Without coordination with allies and a clear long-term vision, the U.S. risks ceding its central position and allowing these nations to further develop and penetrate its economic infrastructure. Without careful coordination with allies, the U.S. risks falling into a more fragmented, less efficient global system, where economic goals take a backseat to political signaling. The result could be higher costs, weaker supply chains, and fewer options for consumers—especially those already struggling to get by.

Death by a Thousand Packages

With the U.S. dismantling the very postwar trade architecture it once championed, China sees a strategic opportunity to fill the vacuum—entrenching itself in the institutions and supply chains. The suspension of de minimis is more than a nuisance to U.S. Customs; it’s part of a much larger shift toward unilateralism, one in which the U.S. wields economic leverage to demand compliance from allies and adversaries with impunity. In doing so – especially in the unprecedented and short-sighted way it is being implemented – it risks undermining the very system that has enabled it to be in this position in the first place. The irony is stark: for decades, the U.S. was the primary architect and greatest beneficiary of the liberal economic order. Now, by turning that order into a tool of coercion against friend and foe, it hands China a geopolitical gift of the century.

This isn’t the post–Cold War world where the U.S. stood uncontested as the de facto omnipotent power. Beneath the surface, a deeper internal rot has been festering for decades—one marked by crumbling infrastructure, rising inequality, inflated healthcare costs, and political paralysis. Rather than confront these internal crises head-on, the current administration lashes outward, using trade policy as a tool of distraction rather than strategy. What emerges is a pattern of haphazard, unilateral decisions—reckless trade measures that signal not strength, but a façade of power. These moves are less about long-term national interests and more about appeasing a protectionist class of ideologues who have penetrated this administration.

Reforming the global trade system requires rebuilding trust, working alongside partners, and wielding economic leverage in a way that fosters—not fractures—alliances. In this way can the U.S. build a fairer system that prevents China from consolidating global influence. But that can’t happen when negotiations are conducted at gunpoint.

In its effort to preserve a flailing U.S. empire, the Trump administration is, paradoxically, digging its own grave—shredding the very economic order the United States once built and led, and creating a vacuum that its greatest adversary is now poised to fill. Decline doesn’t arrive all at once. It creeps in—package by package, tariff by tariff: a thousand missteps and a thousand cuts.